BDO’s 2025 Board Survey

What’s on Deck for Growth?

In today’s competitive landscape, organizations cannot afford to pause their growth objectives — even as they navigate ongoing market volatility and uncertain economic indicators. For boards, this means that strategic oversight must not only drive expansion but also see that it is proactively managed. By balancing the pursuit of opportunity with robust risk mitigation, boards support companies’ effectiveness in delivering sustained value while protecting stakeholder interests.

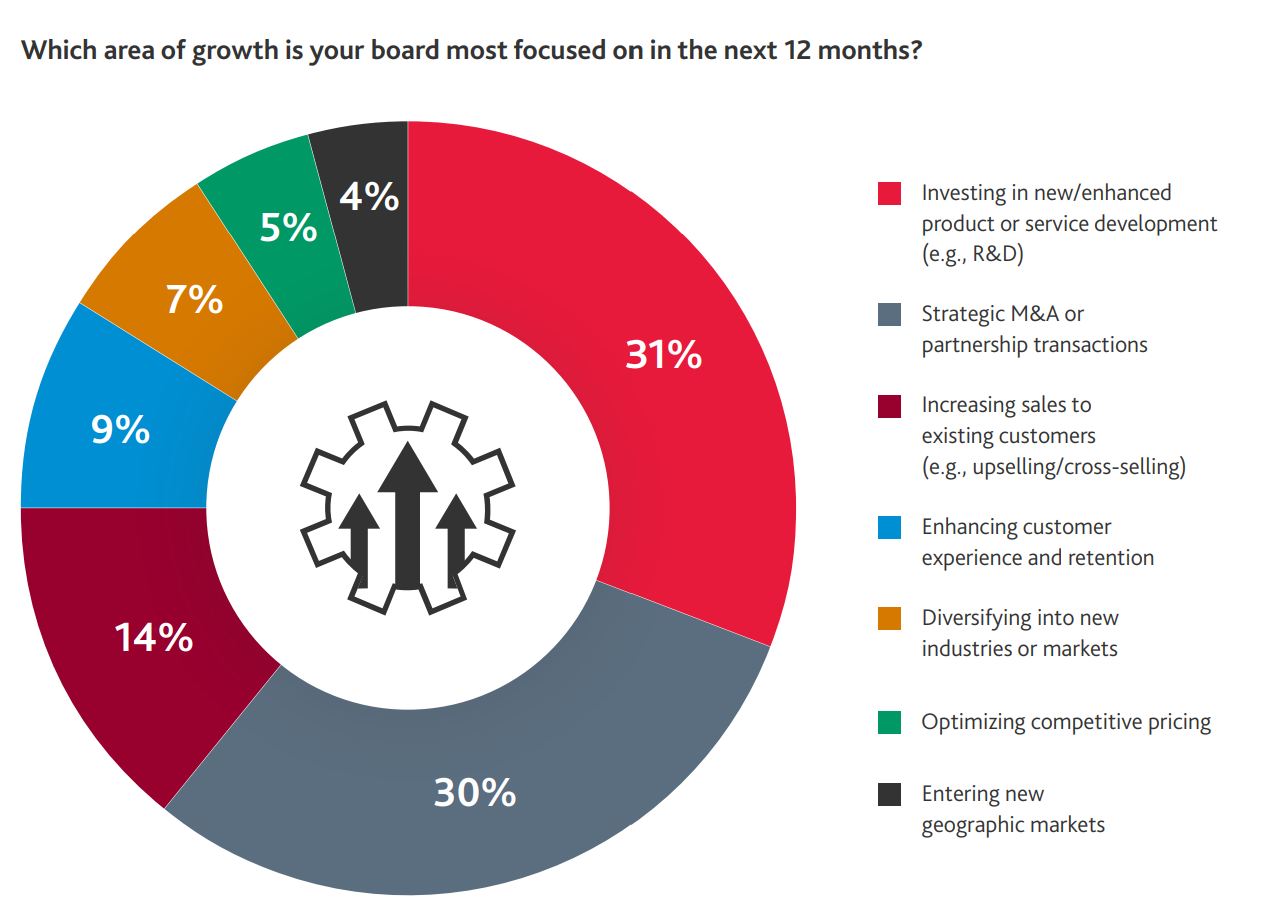

Directors’ plans for both strategic and compliance-related investment show a consistent focus on two primary growth strategies: innovation of products and services — including investment in technology and its use — and M&A and transactions.

WHERE ARE BOARDS PRIORITIZING STRATEGIC TIME & EFFORT AND INVESTMENT?

Beyond growth, the board has a heightened focus on advancing strategic priorities pertaining to the use of emerging technology, managing capital allocation, and optimizing margins, reflecting the need for strategic oversight in areas that directly impact long-term competitiveness and resilience. Technology is transforming industries at an unprecedented pace. Close to a third of board directors (32%) point to their role in helping organizations not only adopt relevant technologies but also manage associated risks — such as cybersecurity, data privacy, and ethical considerations — to safeguard reputation and stakeholder trust.

A quarter of directors (25%) further cite the need to spend more time overseeing capital allocation — whether through investments in growth initiatives, returning capital to shareholders, or optimizing balance sheets. Director involvement in capital decisions should be informed by robust scenario planning and risk assessment to best position the company in seizing opportunities while maintaining financial flexibility. As companies seek to move toward new strategies, existing structural and operational deficiencies become front and center. For example, many companies are learning the hard way that to successfully adopt technology, they first need to address any “technology debt” that has arisen from delayed integration of disparate systems, poorly maintained systems, and/or lack of robust data governance and protection protocols.

Similarly, investing time and effort in optimizing margins, embraced by 15% of directors, is vital in an environment marked by inflationary pressures, supply chain disruptions, and rising costs. Boards view their roles in these three areas as central to operational efficiency, cost containment, and supportive of strategic pricing decisions, all of which contribute to maintaining profitability and shareholder value.

Amid the AI boom, companies remain focused on ways they can enhance or expand their offerings to deliver and generate more value. Nearly one-in-three (31%) directors say that their board is most focused on investing in new products and services for growth in the year ahead.

Directors and management teams will continue to consider competing resource demands in areas that drive true growth and innovation, and those that address pressing operational needs or technology debt. Both are essential, but the tradeoff calculation will vary based on the organization’s competitive position and structural or security needs. There is also a blurring of lines between operational and technology needs as investments in innovation and human capital become more mutually dependent. Refer to The Boardroom Mindset: Key Considerations for Building Tech-Literate Boards in the Age of AI.

Technology Innovation & Implementation Readiness

As with prior years, directors are focused on both top- and bottom-line opportunities for emerging technology. Boards are prioritizing generative AI in product and service development (41%) and see customer experience (34%) as their greatest opportunities in the coming year. Roughly three-in-four directors plan increased strategic investments in R&D (73%) and emerging technology (74%) for the year ahead. Approximately two thirds of directors also plan to increase strategic and compliance-related investments in cybersecurity, data privacy, and governance.

Boards see significant opportunities in generative AI, particularly in product/service development (41%) and customer experience (34%) — notably both consumer-facing.

Nearly 1/3 (32%) say advancing the use of emerging technology implementation will require the most board time and attention.

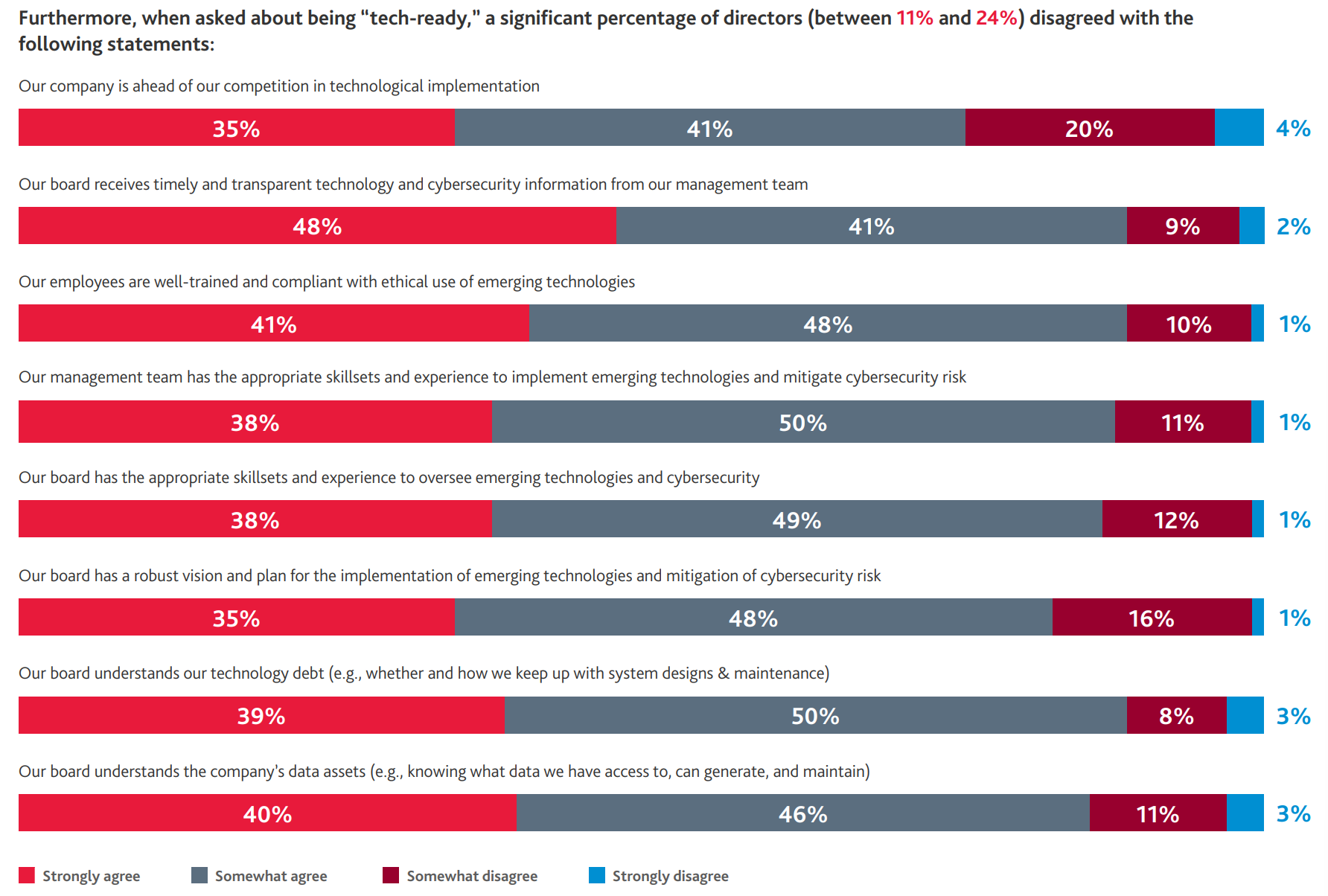

13% of directors and 12% of management teams do not have appropriate skill/experience to oversee emerging technology and cybersecurity.

23% somewhat or strongly believe their company is lagging in technological implementation.

44% plan to seek external assistance for oversight of technological innovation and implementation.

Boards perceive significant risk if their companies do not keep pace with innovation and capitalize on generative AI and other emerging tech opportunities. Approximately a quarter of directors (23%) believe their company is lagging their competitors in technology implementation, and the ability to rapidly innovate new capabilities is the top cited challenge posed by generative AI.

There’s good reason for concern. A recent MIT study found that 95% of companies’ generative AI pilots fail to produce measurable return on investment (ROI) that were attributed to poor integration with workflows, misaligned priorities, lack of knowledge and organizational readiness, and ability to scale outside a \”lab testing environment\” – these fall outside technical flaws in the AI itself. Failure is a part of innovation, but as ROI pressures continue to mount, boards need to be asking questions about why pilots are failing. For example, are employees being given opportunities to plan and ‘sandbox’ ideas and then mitigate any issues before a broader unveiling?

The challenges indicated below signal areas where further thought and consideration are needed to execute an effective and efficient generative AI adoption strategy:

What is the most significant challenge to your business posed by generative AI?

| 23% | Ability to rapidly innovate and develop AI capabilities |

| 20% | Protect against data privacy or cybersecurity threats |

| 16% | Training talent to address generative AI adoption, deployment, and related risks |

| 9% | Prevent inaccurate/biased inputs and/or outputs or hallucinations |

| 9% | Ability to prioritize use cases |

| 6% | Resistance to adoption within organization (e.g., job loss, damage to employee morale/loyalty) |

| 5% | Ability to assess potential cost |

| 5% | Maintain foundational data hygiene and infrastructure |

| 4% | Complying with standard setting around ethical & irresponsible use |

| 3% | No specific AI adoption concerns |

Companies have learned from prior implementation in advanced technology that the human side of innovation is just as important as the technical side. Resistance to change, lack of training, and the growing fear of AI-related job loss can stand in the way of successful piloting and implementation. The need for human buy-in and championing of adoption is leading to increased attention on workforce strategies (see *The Human Element* section of this report for more). As a result, capital allocation and investment decisions will be further complicated by the growing need for training and change management initiatives that will make or break the success of technological investments.

KEY TAKEAWAYS FOR TECHNOLOGY READINESS

Technology governance is a board-level priority.

Directors must ensure their organizations are equipped to both seize opportunities and manage risks associated with emerging technologies.

Skills and expertise gaps remain a concern.

Ongoing education, recruitment, and external support are essential for effective oversight and management.

AI and other technologies are seen as growth drivers, especially in consumer-facing areas.

Boards should balance innovation with robust risk management, especially in cybersecurity.

A significant portion of companies feel they are behind in tech adoption.

Proactive strategies and benchmarking are needed to close the gap.

External resources are increasingly important.

Boards should consider how best to leverage outside expertise to strengthen oversight and implementation.

For more, refer to BDO’s Top Boardroom Conversations on Technology Governance.

M&A for Growth

Following years of dealmaking declines, boards appear to be gearing up for an M&A comeback. In the first half of 2025, global M&A value reached $2 trillion, an increase of 13.6% over the same period in 2024[1], according to PitchBook. Given greater policy and operating clarity, buyers and sellers can finally act on pent-up dealmaking demand in 2026. To succeed in 2026, businesses must understand the core drivers of their M&A strategies and identify deals and deal structures that align with their strategic objectives. For more, refer to BDO’s 2025 M&A Recap and 2026 Outlook.

As expectations of a return to dealmaking have been forecasted for several quarters, our survey finds directors are moving from anticipation to action. A majority plan to increase strategic investment in M&A, and transaction opportunities are the second most cited growth strategy for the year ahead.

To prepare, directors will look first to verify they have access to capital. Then, look toward having the right team in place, including prioritizing M&A experience on their board and in the C-suite, and access to financial, accounting, legal, and other advisory support for pre-deal due diligence and post-deal integration planning.

- 30% of directors say their board is most focused on strategic M&A or partnerships for growth

- 53% plan to increase strategic investment in M&A

- 51% plan to seek external help on M&A due diligence and/or integration

BDO’s Take

While boards remain optimistic about strategic M&A in the coming year, they are equally aware of the challenges and risks that are present throughout the M&A process. Directors recognize that improving ROI requires more than just closing a transaction —it demands a comprehensive understanding of deal terms, especially for leaders who may not be serial acquirers. In this context, having access to objective advisors is critical, both to navigate a complex regulatory landscape and to provide unbiased insight into prevailing market conditions — whether favorable or unfavorable.

Moreover, the importance of rigorous due diligence cannot be overstated. Boards must check that every aspect of a potential deal is thoroughly vetted, from financials and operations to cultural fit and technology integration. For example, amid volatile tariff and trade negotiations, cost considerations and supply chain availability analyses for components and materials need to be well understood, including the buyer’s warranty expectations for such items, to assess overall valuation impact. Boards should also consider regulatory and antitrust risks, tax implications, cybersecurity and data privacy, intellectual property, and contractual obligations. Human capital issues, stakeholder communication, and ESG factors are increasingly critical to successful outcomes. Yet even the most carefully structured deal is only the starting point. The real value is realized through disciplined post-implementation project management which requires a clear plan for integration, onboarding, change management, and ongoing measurement of results. Directors understand that bridging the gap between initial excitement and long-term profitability of a deal hinges on sustained focus, robust oversight, and the ability to adapt as challenges arise.

The Human Element

In addition to providing oversight around generative AI and technological innovation, directors are also looking into additional skills and experiences that can enhance a board’s ability to govern, drive culture, and develop the C-suite to drive long-term strategy. From tone at the top — including the relationship between the board and C-suite — to changes in broader workforce needs, the people side of business remains a significant priority. This is underscored by approximately half of directors indicating increases to their spend on workforce, both strategic- and compliance-related.

Human Capital Engagement

Low unemployment, estimated to be 4.3% as we entered the fourth quarter of 2025, is being countered by reports of weak job creation and growth throughout the previous spring and summer months.[2] Dynamics at the top and bottom of organizations have diverged. According to a recent report from Challenger, Gray and Christmas, CEO turnover is at a record high with more than 1,300 CEOs departing their posts through July 2025.[3] On the other hand, following years of prevalent job hopping, Korn Ferry reports that more employees are clinging to their existing roles, or “job hugging,” given job growth stagnation, AI disruption, and fear of layoffs.[4] For employers, less turnover across the workforce can lead to opportunities for more strategic talent development and upskilling, in addition to reducing turnover costs spent on recruiting and onboarding.

Workforce development is gaining significant traction, with 51% of directors planning increased general workforce investment and an equal percentage specifically targeting training and skill development programs. However, organizations may struggle in prioritizing workforce investments with other competing resource needs.

PEOPLE & CULTURE

The past decade or more has experienced increased discussion about the need for human resource skills in the boardroom. Directors’ responses, however, signal they believe talent management is primarily a C-suite responsibility, ranking people and culture in the top five most important C-suite skillsets.

While few directors expect workforce-related matters to demand a significant amount of their time compared to other strategic priorities, 44% rank operational transformation and change management as the most in-demand skillset for their management team.

Directors appear clear-eyed on the need to garner ROI through change management, but they may be underestimating AI’s potential impact on workplace dynamics and culture. For example, more than one in ten directors (11%) report that their company plans to decrease investment in their workforce.

Amid both the reality of slow job growth and concern about technology impact, an August poll by Reuters/Ipsos found that 71% of U.S. adults are worried that AI will put too many people out of work permanently.[5] Widespread fear in the workforce will likely be counterproductive to realizing organizational growth goals and ensuring effective technology adoption and buy-in, so boards and management teams need to be thoughtful in communicating and rolling out AI-enablement plans and upskilling opportunities. As it stands, 58% of directors see room for improvement in their management team’s work on talent oversight and workforce development — an area that is likely to grow more complex in the coming year.

More information can be found in our forthcoming 2026 Priorities for Compensation Committees, to be released later in 2025.

- Just 3% of directors believe that optimizing culture and workforce management will require the most attention from their board in the next year.

- Only 12% say that risks related to changing workforce landscape and retention of talent will require the most board time and effort to address.

Board & C-Suite Dynamics & Effectiveness

Aside from strategic and financial expertise, directors were asked to indicate up to three of the most critical skillsets and experiences needed to enhance the current composition of both the board and the C-suite management team:

Most important skillsets and experience needed to enhance composition:

| Board Members | Management Teams | ||

|---|---|---|---|

| Technology and Innovation | 42% | Operational Transformation/ Change Management | 44% |

| Cybersecurity | 35% | Technology and Innovation | 38% |

| Industry Experience | 34% | People and Culture | 25% (TIE) |

| M&A/Transactional | 28% (TIE) | Industry Experience | 26% (TIE) |

| Operational Transformation/ Change Management | 28% (TIE) | Cybersecurity | 24% (TIE) |

| ESG Metrics and Reporting | 20% | Marketing/Branding | 24% (TIE) |

| Legal and Regulatory | 19% | M&A/Transactional | 22% |

| Marketing/Branding | 18% | International Experience | 21% |

| International Experience | 16% | Crisis Preparedness | 17% (TIE) |

| Crisis Preparedness | 14% (TIE) | Legal and Regulatory | 17% (TIE) |

| People and Culture | 14% (TIE) | ESG Metrics and Reporting | 11% |

For a more detailed breakdown and comparison of “How Boards View Themselves & Their C-Suite” across prioritization of risks and opportunities, skillsets, and composition, please subscribe to our LinkedIn newsletter series The Boardroom Mindset.

A Focus on Board Evaluation & Refreshment

Zeroing in on the composition, construct, and operation of the board, our survey findings reflect recognized needs for improvement. For example:

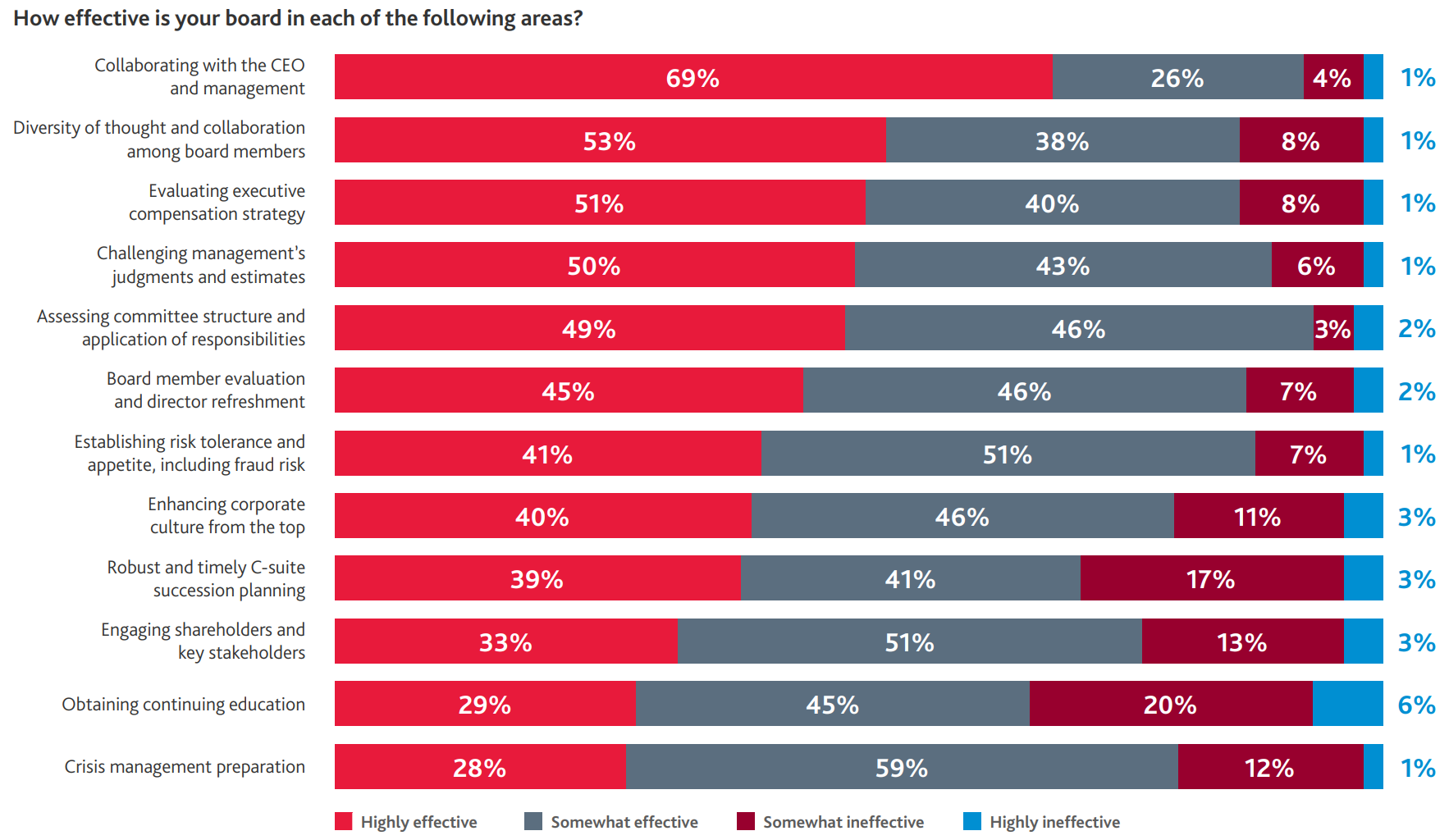

- Directors express confidence in collaboration, oversight, and diversity of thought, but less so in continuing education, crisis management, and stakeholder engagement.

- Skill gaps in technology, innovation, and cybersecurity — identified as top board priorities — are likely contributing to lower effectiveness in areas like setting risk tolerance & appetite, pursuing continuing education, and crisis management.

- Director refreshment and committee structure are considered moderately effective, but used to bring needed expertise and commit to ongoing improvement.

More information can be found in our forthcoming 2026 Priorities for Nomination & Governance Committees, to be released later in 2025.

COMMUNICATION, COLLABORATION, & C-SUITE SUCCESSION PLANNING

There is common agreement that the board’s most important job is hiring and firing the CEO, but it’s also clear that the relationship between the board and CEO can significantly impact company success. A recent National Association of Corporate Directors (NACD) Blue Ribbon Commission report highlights the importance of building a high-trust board-CEO relationship through a proactive, three step approach: building a foundation of trust, operationalizing that trust, and leveraging the trust for impact. To paraphrase the report, the relationship between the board and the CEO will continuously be tested but building trust can’t be done during the critical moments when it is most needed.

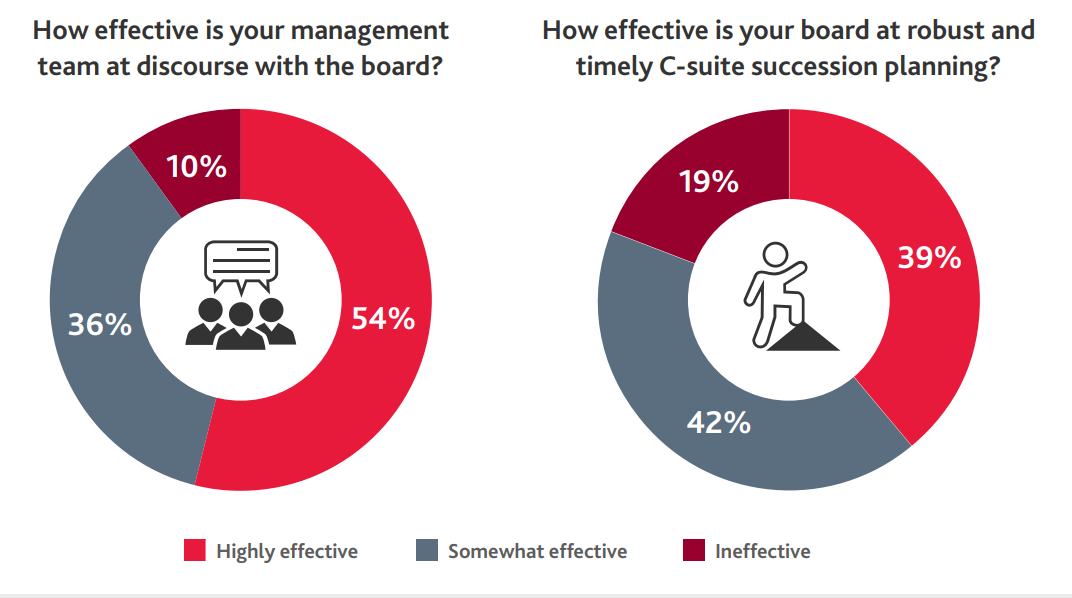

Most directors surveyed give their board and management team high marks for communication and collaboration. The data, however, indicates that there may be an opportunity for boards to increase their management oversight effectiveness through healthy discourse, professional skepticism and robust talent planning. For example, just 39% say they are highly effective at robust and timely succession planning. While CEO succession planning tends to get the most attention, highly functioning directors and management teams are also focused on development of a strong leadership pipeline across the C-suite and beyond. Boards who do this best begin building relationships with and observing both the strengths and areas for improvement of both current C-suite leaders and their direct reports well before a C-suite or other leading role opens up.

BDO’s Take

In an era marked by dependency on short-form communication (i.e., texts, social media posts, emojis, etc.) combined with many still working outside of the workplace, human skills of communication, empathy, and understanding seem a bit like lost arts for many. The ability to motivate, enable, and engage the workforce cannot be delegated or outsourced to technology, nor can the substantive conversations among leaders that drive major decisions.

With a record number of CEO and C-suite transitions, the rise of the agentic workforce, and the U.S. policy change ripple effect of government layoffs across other industries, employees at all levels may worry about job security. That type of pressure can drive excellence and increase effort, or it can create distractions that stifle innovation and responsible risk taking.

In addition, a reduction in overall workforce and entry-level hiring has resulted in moves toward diamond vs. pyramid shaped organizations that may have negative downstream impacts on a company’s ability to develop the next generation of leaders and build a collaborative and desirable culture that drives loyalty and trust to foster innovation and growth. How boards and C-suites work together during this period of uncertainty can make the difference in achieving growth, maintaining resiliency, and protecting against risk.

For more, view our insight: Bridging the Gap Between the Board and C-Suite and access ongoing continuing education and resources from the BDO Center for Corporate Governance.

PERCEPTIONS ON EFFECTIVENESS

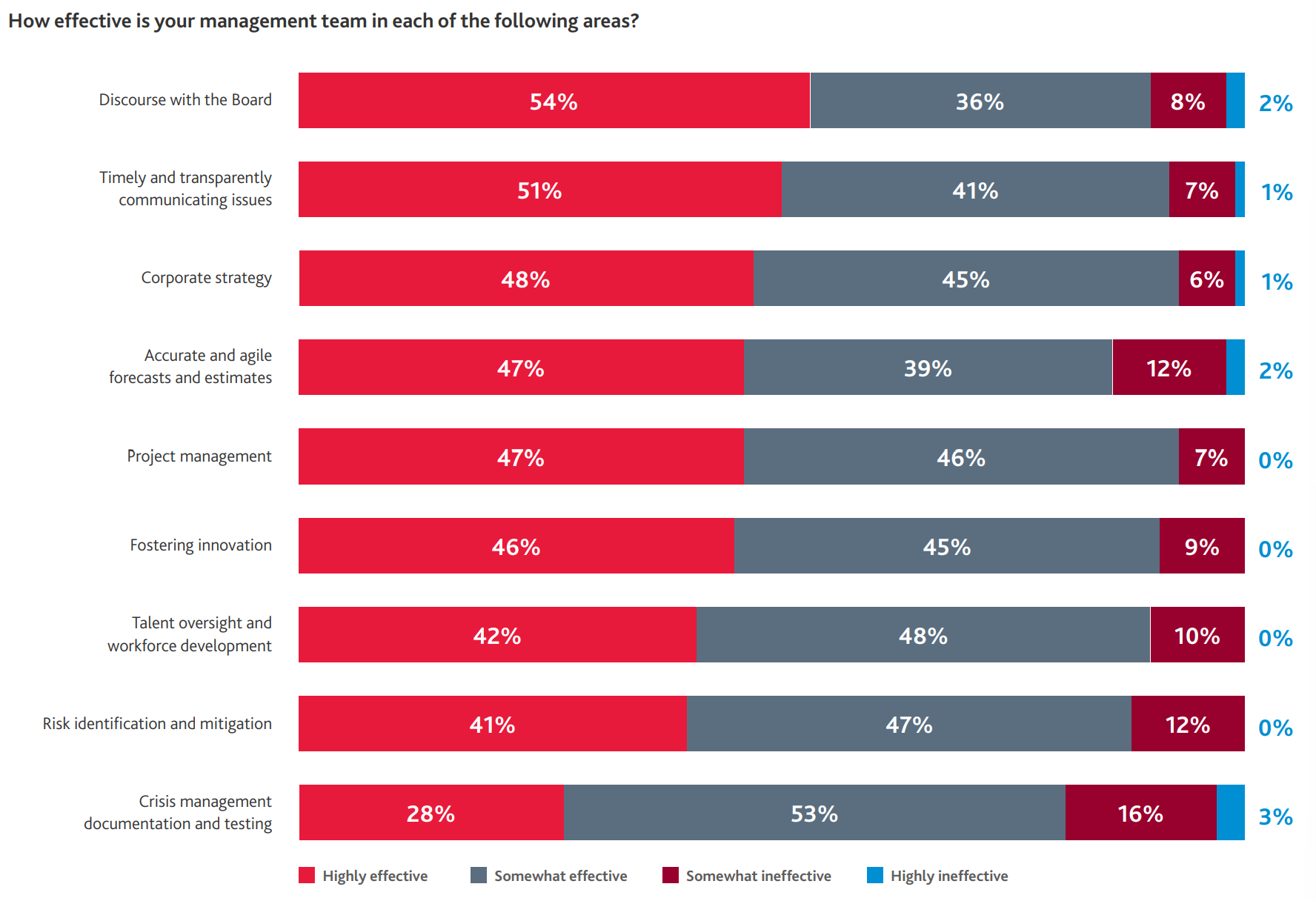

We asked directors to provide their perspectives about the effectiveness of both the board and management across several areas from highly effective to highly ineffective. We have woven many of the findings below into our discussion throughout this publication:

Turning Oversight to Foresight

As boards enter 2026 with a focus on growth, directors report an opportunity for improvement in proactive risk management as a throughline across several governance areas. From cybersecurity and forecasting, to declines in demand and workforce issues, the risks are widespread, and there’s no clear consensus on what will take the most time. Boards and management teams signal focus on diverse risks specific to their own company priorities. So, what does this mean?

Which of the following business risks will require the most board time and effort to address in the next 12 months?

- 15% Cyber threats/incidents and data protection policies and procedures

- 15% Unpredictability in financial forecasting

- 14% Declines in demand for product/service

- 14% Lagging implementation of emerging technologies

- 12% Changing workforce landscape and retention of talent

- 11% Liquidity and access to/cost of capital

- 8% Regulatory compliance

- 7% Supply chain disruption

- 4% Stakeholder pressure to address climate

While risk priorities appear widespread, only 41% of directors consider themselves highly effective at setting risk tolerance and appetite, including fraud risk. Similarly, just 41% rate their management team as highly effective in identifying and mitigating risks.

Productive relationships between boards and management teams require appropriate challenge and debate. Still, only 50% say their board is highly effective at challenging management’s judgments and estimates while 46% and 49%, respectively, indicate management has more work to do in their discourse with the board and in providing timely and transparent communication to the board. C-suite leaders should be encouraged to raise tough issues early and engage the board directly, and directors should establish expectations for open dialogue from management and in turn be approachable and receptive to timely information, whether good or bad.

- Only 28% believe their boards and management teams are highly effective at crisis management preparation; while 13% and 19%, respectively, are believed to be somewhat or highly ineffective.

- Only 41% say their management team is highly effective at-risk identification and mitigation; while 13% indicate somewhat or highly ineffective.

- Additionally, 50% believe the board is highly effective at challenging management’s judgments and estimates but 14% indicate room to improve management’s ability to provide accurate and agile forecasts and estimates.

CYBERSECURITY, DATA PRIVACY, & DATA GOVERNANCE

The past year saw a 34% increase in attackers exploiting cyber vulnerabilities to cause security breaches, according to Verizon.[6]

As boards work to understand their company’s technology debt, data security and governance are prevailing as the most important aspects of a strong cybersecurity framework.

Boards seem to be clear in where their focus needs to be in this area:

- 63% of directors plan to increase strategic investment in cyber-security in the year ahead

- Cybersecurity is the 2nd most in demand skillset for boards in 2025

- 15% of directors say cyber threats/incidents and data protection policies and procedures will require the most board time and effort to address over the next year

When evaluating the organization’s cybersecurity needs, it’s important for the board, management, and IT teams to be aligned on how security frameworks can fit into overall business goals. For more information on how to reduce cyber risk as your business evolves, read our insight on IT strategy, governance, and alignment.

LIQUIDITY AND ACCESS TO CAPITAL

Unpredictability in financial forecasting ranks as a top business risk with 15% of directors viewing it as a concern requiring the most time and effort over the next 12 months. Compounding their concern, less than half of directors (47%) express confidence that their management team is highly effective at creating accurate and agile forecasts, and another 14% say they are somewhat or highly ineffective.

Both findings reflect a critical governance challenge: Directors and management teams are struggling with predicting financial outcomes and securing and deploying resources effectively. As a result, a quarter of directors (25%) feel that managing capital allocation is the strategic priority that will take the most board attention; while another 11% of directors indicate that liquidity and access to/cost of capital is the business risk that will require the most board time and effort to address.

CRISIS MITIGATION

As boards seek to improve their ability to identify and predict business threats, it can be challenging to convert this knowledge into actionable crisis preparedness. New technologies, increased politicization, changing regulatory requirements, and unstable economic conditions continue to create scenarios that can catch companies off guard.

While it’s not possible to plan for every scenario, 28% of directors feel their boards and management teams are highly effective in crisis management preparation.

BDO’s Take

What do these various risks have in common? Risk identification is only half the battle. The real challenge lies in building the frameworks, protocols, and muscle memory needed to act decisively when threats become a reality — a skill that can’t be fully outsourced or solved with better technology alone.

Risk management is a company-wide endeavor aided through scenario planning, continuously revised with real-time data to reinforce crisis preparedness, and better inform and improve upon organizational risk mitigation strategies moving forward.

As your board and management team discuss how to create better risk mitigation strategies and proactively manage crises, read our 2025 Global Risk Landscape report to see how your peers are responding to the latest macroeconomic and regulatory challenges.

Conclusion

As boards prepare for 2026, the evolving business landscape demands that directors and management teams sharpen their effectiveness across strategic oversight, risk management, and workforce development. Addressing skill gaps, enhancing crisis preparedness, and prioritizing human capital are essential for sustaining growth and resilience. Ongoing education and proactive collaboration between boards and management will be critical to navigating technological change and emerging risks. By fostering open dialogue and leveraging diverse expertise, organizations can better anticipate challenges and seize opportunities, positioning themselves to deliver lasting value in a dynamic environment.

1 Data provided by Pitchbook. (go back)

2 Data provided by the U.S. Bureau of Labor Statistics. (go back)

3 Data provided by Challenger, Gray & Christmas. (go back)

4 Data provided by Korn Ferry. (go back)

5 Data provided by Reuters. (go back)

6 Data provided by Verizon. (go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.